Reporter Richard Lake of WJTV reports that the Mississippi State Senate counter-offer on Medicaid Expansion is a “private option” styled like the current implementation that Arkansas uses for Medicaid Expansion:

Arkansas basically does this already.

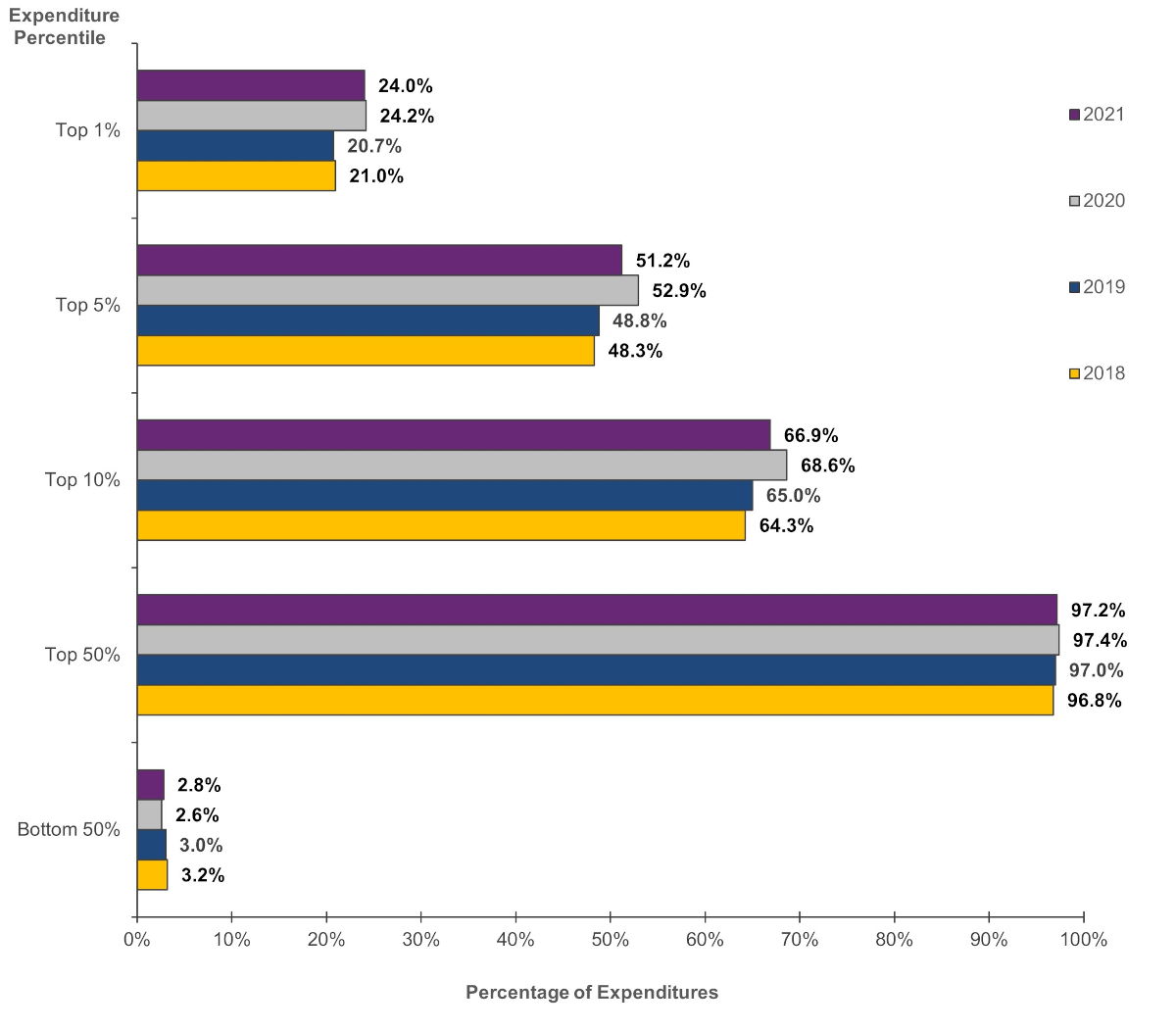

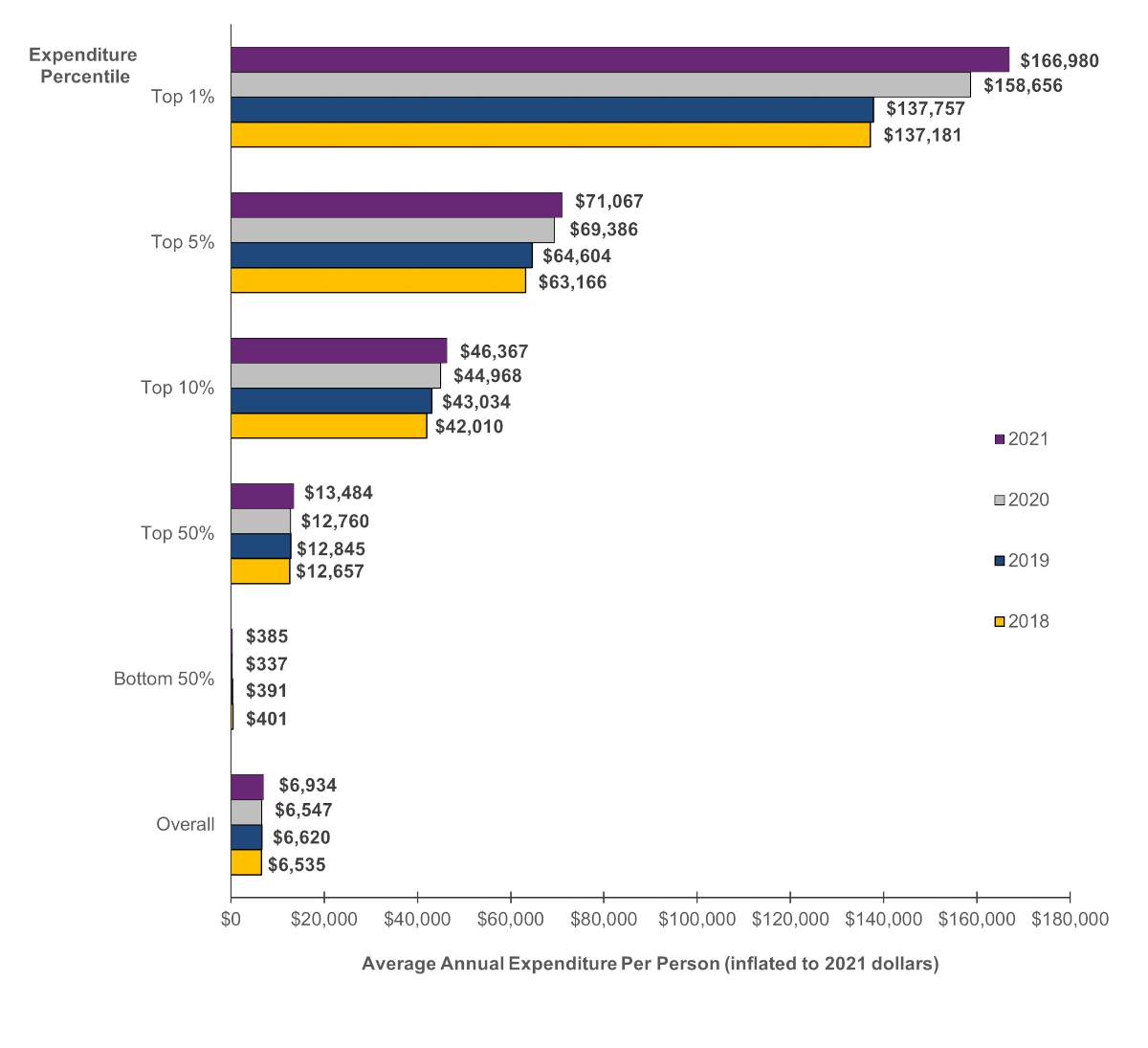

It is more expensive for the state and federal government. It probably does not matter much, if at all for beneficiary health and financial outcomes.

The Biden Administration would, in my opinion, approve this waiver in thirty three seconds flat.

The big hold-up is the insistence on adding work requirements to the program which will not be approved by the Biden Administration.

Mississippi wants an Arkansas style Medicaid Expansion?Post + Comments (11)