Tomorrow afternoon, my co-author Dr. Alex Hoagland of the University of Toronto will be presenting our paper Medical Bill Shock and Imperfect Moral Hazard to the Electronic Health Economics Colloquium (EHEC) at 14:00 ET on Zoom. It is an open presentation.

We want to know how does the provision of accurate billing information change the consumption of medical services. We live in a society where we make policy with the assumption that people are reasonably rationale and forward looking so patients are intended to act as consumers. We know from other research that people are really bad at responding to clean incentives from deductibles but we wonder how good are people at guessing what they owe and does this matter?

PEOPLE ARE REALLY BAD AT GUESSING WHAT THEY OWE

AND IT MATTERS A LOT!

We use a triple difference design to estimate changes in consumption before and after the arrival of a bill for Household Member A for everyone else in the household.

Below is a bunch of economic-speak from our abstract:

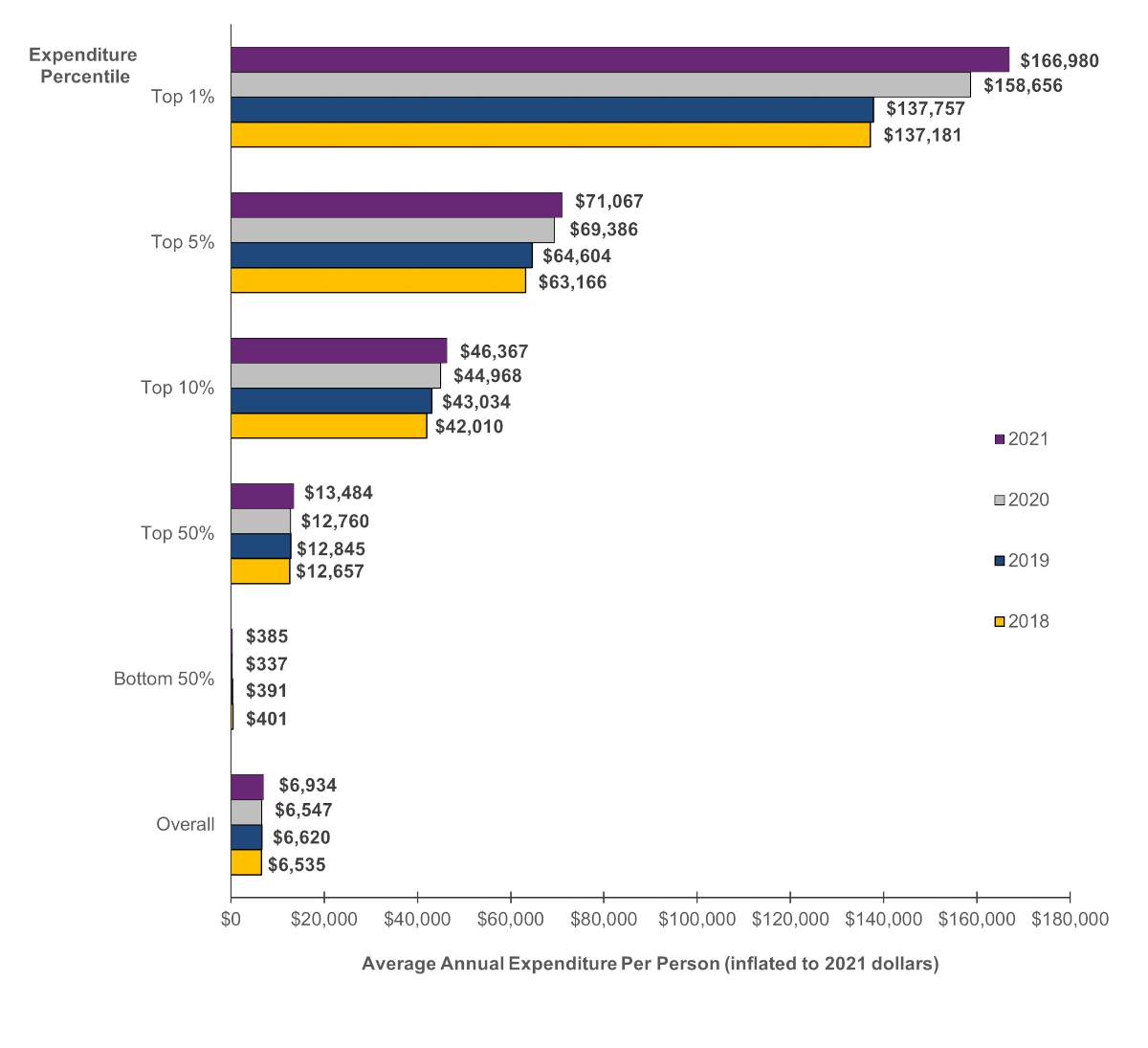

Consumers are sensitive to medical prices when consuming care, but delays in price information may distort moral hazard. We study how medical bills affect household spillover spending following utilization, leveraging variation in insurer claim processing times. Households increase spending by 45% after a scheduled service, but this is curtailed by 15% after the bill arrives. Bill effects are driven by learning about prices from particularly informative bills, and affect the type and location of care received. A model of household belief formation with delayed information suggests households overestimate expenditures by 10%, ultimately over-consuming an average (median) of $842.80 ($480.59) annually.

This is, I think a BFD… and I would love for some of the econy and academic Jackals to join us tomorrow.

Guessing cost-sharing wrong matters a lotPost + Comments (44)