This is a follow-up from this morning’s post on cost sharing. I was curious what it would take to create a 70% actuarial value plan where there was only one form of cost sharing and no frills to it.

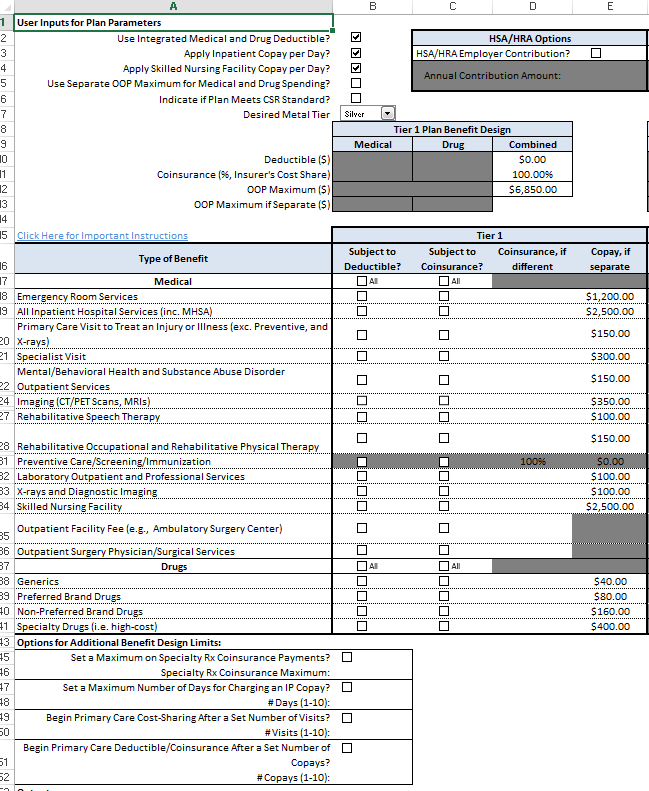

I used the 2016 CMS AV Calculator for Exchange as my tool. You can play with it as a macro enabled Excel file.

Creating a deductible only plan was fairly simple. The insurance would pay nothing out until the person spends $3,725 on cost-sharing eligible services.

The co-insurance routine was a bit harder to build. There are a wide ranges of co-insurance rates that could be chosen. For simplicity sake’s I chose a $0 deductible and a 40% co-insurance rate to start with. That failed. I could not design a Silver plan using only co-insurance at 40% before I hit the maximum out of pocket constraint of $6,850.

A 50% co-insurance rate creates a 72% Silver plan while a co-insurance rate of 53% creates a 70% Silver plan. The out of pocket maximum for these plans are $6,850.

I will not even try to describe what I had to do to get a co-pay only plan. Below is a screen shot

Again, maximum out of pocket is $6,850 and most of that will be paid for by people who have inpatient admissions and high end specialty medications. The PCP co-pay is high enough that no one will ever go see their doctor for little things.

The problem is not the deductible. The problem is low actuarial value of coverage combined with the high cost of services.

guachi

I’m glad I haven’t and likely never will have to ever choose my health care plan.

Miss Bianca

I still haven’t quite grokked the difference between “co-insurance” and “co-pays”. Is one based on a percentage of the costs of services, and one based on a set fee?

Richard Mayhew

@Miss Bianca: yes. Co-pay is a flat fee (example $30 for a primary care visit). Coinsurance is a percentage of the rate set by the contract between doc and insurance company. Example 20% of a 300 cardiology visit

Brachiator

The New York Times article on the urgent care business was very interesting as a sidebar to these discussions. You have insurance and co-pays on one side. The urgent care business gets into the options that people have for choosing providers of service. The intersection has to affect costs of providing health care. This was an insightful nugget.

With more people insured, does this increase the potential patient pool for urgent care outfits?

Mnemosyne

@Brachiator:

It’s probably also because most insurers have a smaller copay for urgent care than they do for the ER. With my insurance, I think it’s $50 vs $200, though IIRC I don’t have to pay the copay if I get admitted to the hospital via the ER. And if you can’t take time off work to deal with a minor issue, urgent care can be a good option.

Brachiator

@Mnemosyne:

And if it is not an actual emergency, and you can get treated quickly, urgent care would seem to be a more rational choice and better use of medical resources, apart from copay issues.

There is an urgent care facility in a Kaiser medical suite. I see adults and mothers with children filling the place. I wonder if they may not have personal physicians they can get to, or if stuff like not being able to take time off work, as you note, influences choices.