Several related stories. First, KTHUG:

Yet in the 1950s incomes in the top bracket faced a marginal tax rate of 91, that’s right, 91 percent, while taxes on corporate profits were twice as large, relative to national income, as in recent years. The best estimates suggest that circa 1960 the top 0.01 percent of Americans paid an effective federal tax rate of more than 70 percent, twice what they pay today.

Nor were high taxes the only burden wealthy businessmen had to bear. They also faced a labor force with a degree of bargaining power hard to imagine today. In 1955 roughly a third of American workers were union members. In the biggest companies, management and labor bargained as equals, so much so that it was common to talk about corporations serving an array of “stakeholders” as opposed to merely serving stockholders.

Squeezed between high taxes and empowered workers, executives were relatively impoverished by the standards of either earlier or later generations. In 1955 Fortune magazine published an essay, “How top executives live,” which emphasized how modest their lifestyles had become compared with days of yore. The vast mansions, armies of servants, and huge yachts of the 1920s were no more; by 1955 the typical executive, Fortune claimed, lived in a smallish suburban house, relied on part-time help and skippered his own relatively small boat.

The data confirm Fortune’s impressions. Between the 1920s and the 1950s real incomes for the richest Americans fell sharply, not just compared with the middle class but in absolute terms. According to estimates by the economists Thomas Piketty and Emmanuel Saez, in 1955 the real incomes of the top 0.01 percent of Americans were less than half what they had been in the late 1920s, and their share of total income was down by three-quarters.

Today, of course, the mansions, armies of servants and yachts are back, bigger than ever — and any hint of policies that might crimp plutocrats’ style is met with cries of “socialism.” Indeed, the whole Romney campaign was based on the premise that President Obama’s threat to modestly raise taxes on top incomes, plus his temerity in suggesting that some bankers had behaved badly, were crippling the economy. Surely, then, the far less plutocrat-friendly environment of the 1950s must have been an economic disaster, right?

But, after decades of unprecedented greed, shoveling their filthy lucre into tax-free investments and off-shore accounts, the electorate is starting to get sick of it:

Two post-election polls – one released Nov. 14 by the Democracy Corps (founded by Stan Greenberg and James Carville), the other released Nov. 16 by the Public Religion Research Institute – reveal the decisively liberal views of the core constituencies within the rising American electorate and its support for government activism, especially measures to help the disadvantaged.

The findings from the P.R.R.I. survey are very illuminating:

*When voters were asked whether cutting taxes or investing in education and infrastructure is the better policy to promote economic growth, the constituencies of the new liberal electorate consistently chose education and infrastructure by margins ranging from 2-1 to 3-2 — African Americans by 62-33, Hispanics by 61-37, never-married men by 56-38, never-married women by 64-30, voters under 30 by 63-34, and those with post-graduate education by 60-33.

Conservative constituencies generally chose lowering taxes by strong margins — whites by 52-42, married men by 59-34, married women by 51-44, all men by 52-41; older voters between the ages of 50 and 65 by 54-42.

*The constituencies that make up the rising American electorate are firmly in favor of government action to reduce the gap between rich and poor, by 85-15 among blacks, 74-26 for Hispanics; 70-30 never-married men; 83-15 never-married women; and 76-24 among voters under 30. Conservative groups range from lukewarm to opposed: 53-47 for men; 53-47 among voters 50-65; 46-54 among married men; 52-47 among all whites.

*One of the clearest divides between the rising American electorate and the rest of the country is in responses to the statement “Government is providing too many social services that should be left to religious groups and private charities. Black disagree 67-32; Hispanics disagree 57-40; never-married women 70-27; never-married men, 59-41; young voters, 66-34; and post-grad, 65-34. Conversely, whites agree with the statement 54-45; married men agree, 60-39; married women, 55-44; all men, 55-43.

This is called a backlash, not a lurch towards socialism. The last three decades of unprecedented growth in wealth for the ultra-rich while unions are smashed, pay remains stagnant for everyone else, and the middle and lower classes have been crushed is the direct cause in the change of the attitudes of the electorate. A quick illustration:

And we see these stories every single day. Millionaire CEO’s who own pizza companies are going to attack their employees because they want… health care. Conservatives want to blame workers making barely livable wages while trying to elect people who spent their lives getting filthy rich gutting other people’s pensions.

It’s a backlash, and the wealthy few have no one to blame but themselves. They started the class warfare three decades or more ago, and have been winning. But folks are tired of being mired in poverty and watching the elite few run over the middle class in their Mercedes. It’s really that simple.

Tom The First

Let’s, for a second, pretend I’m dumb. Does a 90% marginal tax rate mean people who fall into that bracket pay 90% of their income to the government?

Redshift

@Tom The First: No, it means they pay 90% of the portion of their income above the next lower tax bracket (that’s what the “marginal” part means.)

So, to take the example that conservatives have been failing to understand or pretending they don’t understand about the current tax situation, if the Bush tax cuts for incomes above $250K expire and you make $250,001, you get taxed the extra 3% on $1, not $250,001.

cathyx

Well, I agree with the republicans then, we should go back to the 1950’s.

NR

And yet, given all these facts, Obama and the Democrats are still pushing for a deal that has a 3 to 1 ratio of spending cuts to tax increases. And that’s before “negotiation” with the GOP which will undoubtedly skew that ratio even more.

Buying both major political parties was the smartest thing the plutocrats ever did.

WereBear

@Tom The First: It means income above a certain amount was taxed at the 90% rate.

Okay, someone got there first. So let me add that is is an extraordinary brake on greed… and encouraged foundations and other charitable giving.

Commenting at Balloon Juice Since 1937

It seems the constituancy for less government, less taxes on the rich are the hate radio audience. Coincidence?

Chris

Yep.

Here’s hoping that the backlash is sustained and leads to the kind of rollback we saw a hundred years ago. (And here’s hoping that this time, it actually sticks).

danimal

Restoring the middle class needs to be a generational priority. Rome wasn’t looted in a day.

Baud

It’s a backlash, and the wealthy few have no one to blame but themselves

I can think of some other people they will blame.

LanceThruster

I heard some NPR story about a Canadian firm that beat out the US one despite the Canadians being saddled with the universal healthcare of their citizens.

How can that possibly happen?

Wouldn’t that burden being removed from the US companies actually increase their competitiveness?

Another example of how addled Reich Wing “thinking” can be is the meme that they loves them some troops, but still subject them to adapt to the post warrior world (wounded or not) with appeals to private charities, rather than through VA and government programs.

Would the current crop of deep thinking tea-baggers still support the GI bill and the like?

Seems like grifters gotta grift.

Bill Arnold

@Redshift:

This is so pernicious, one wonders what percentage of conservatives do their own tax returns. Or indeed are numerically literate enough to wonder about the strangeness of (their misunderstanding of) a tax code that would punish them with thousands of dollars in extra taxes, for accidentally making an extra dollar.

JWL

“It’s a backlash, and the wealthy few have no one to blame but themselves. They started the class warfare three decades or more ago, and have been winning. But folks are tired of being mired in poverty and watching the elite few run over the middle class in their Mercedes. It’s really that simple”.

Good words, wish I’d written them.

Lurker

@Tom The First:

Nope. Click here and scroll down for the best illustration I have ever seen of the United States’ progressive income tax.

jrg

Every time I hear someone complain about social spending driving up the cost of goods and services, I want to punch them in the neck. Where the hell do people think those insane levels of executive compensation come from? Leprechauns?

? Martin

@Tom The First:

It means that 90% of the income earned in that level goes back to the government. Those brackets were very high. Maybe $10M in income in todays dollars, so $.90 of every dollar earned above $10M would be returned in taxes. It was only a handful of people paying those rates.

But the 50s were unique. A lot of people were happy to pay their high rates and work for not outrageous fortunes. After all, a decade earlier, a ton of people like them were drafted and died fighting a war. Entire nations were economically wiped off the map. Earning a comfortable living was a hell of a thing to be thankful for. Now, not so much.

LanceThruster

@Baud:

The wealthy have no one to blame but the removal of barriers meant to protect them from the competent and competitive “other” that institutionalized their previously unchallenged privileges.

Even those struggling are “lucky duckies” because they don’t know just how hard the elite have to work to try to keep the playing field from being leveled.

Glob forbid they actually put that same effort into competence rather than gaming the system in order to maintain the edge on something other than merit.

Gex

@Bill Arnold: In the punditry and the politicians, this detail about marginal rates is understood and *deliberately* not clarified so the low information voters can get outraged at how big the number is.

Tom The First

Thanks RedShift, WereBear, Lurker and Martin!

ranchandsyrup

Twice over the weekend someone assured me that because we can not raise taxes high enough to “get rid of the deficit” we shouldn’t worry about taxes and entitlements are the only solution. I laughed both times.

Vince

@Tom The First:

No, here’s a basic overview on how marginal tax rates work. Let’s say you have 3 people who each make $50K, $100K, and $1M a year. And let’s say that our marginal tax rates are: $0-$25,000 pay 0%; $25,001-$50,000 pay 10%; $50,001-$100,000 pay 20%; and anyone making over $100,001 pays 30%.

Now here’s how their taxes break down. Since the marginal tax rate for up to $25,000 is 0% that means nobody gets taxed on that first $25K. That leaves us with $25K, $75K, and $999,975K. Next is our second tax bracket which affects up to $50K. Since all three made at least $50K their paid taxes are each $2.5K with $0, $50K, and $999,950 in taxable income left. Our next tax bracket goes to $100K so our taxes are now $10K for our two people who made at least $100K with taxable income left at $0, $0, and $999,900. Our last tax bracked is for anyone making over $100k and affects only one person who will be paying another $299,997 (30% of $999,990).

Our final tally looks like this:

Person A grossed $50,000 paid $2500 in taxes and ends with $47,500 in net income.

Person B grossed $100,000 paid $2500 and $10,000 in taxes and ends with $87,500 net income.

Person C grossed $1,000,000 paid $2500, $10,000, and $299,997 for each bracket and ends with $687,503 net income.

TL;DR Marginal tax rates only affect income over a certain level not below it. If you look at someone flipping burgers at McDonald’s, a manager at McDonald’s, and the CEO of McDonald’s they’re all paying the same percentage for their first $20,000 earned.

different-church-lady

The thing they seem to have lost track of is that you can run a oligarchy on bread and circuses, but not if you stop giving out the bread, and replace the trapeze artists with lecturing.

different-church-lady

@Vince:

Or at least they would be if the burger flipper actually made $20k.

? Martin

@different-church-lady: True. Federal minimum wage works out to $14,500 per year for a standard 40 hour work week, two weeks unpaid (vacation, sick).

Vince

Alright, I tried to edit my comment but it doesn’t seem to have taken. Our hypothetical millionaire is actually paying $2500, $10,000, and $270,000 not $299,997 in taxes which means they earn $717,500 net income not $687,503.

Rosie Outlook

Oh boy! I have been waiting, literally, decades for people to wake up. This is good news for everyone.

Should I start learning how to knit?

wasabi gasp

Bigger the mansion, more room to horde charitable deduction receipts.

Odie Hugh Manatee

Frum was on MSNBC this weekend and if I could have I would have reached through the screen and slapped the fuck out of that nitwit. They were interviewing some WalMart workers about the ‘strikes’ taking place and discussing wages when Frum insisted that worker wages have to stay low since there are so many people in the labor force who are available to work.

Supply and demand determines wages in Frum World. The more workers there are who are not working, the lower the wages should be. He doesn’t give a shit about paying someone enough to get above the poverty line, nope. All he cares about is employers paying as little as they can for labor.

There was an article over at a tech forum I hang out at that really made me laugh at how fucking stupid people can be. Lots of STATES RIGHTS glibertarians hang out there and in this case a few smart people had to come in and stop the idiots from shooting themselves in both of their feet.

The article was about Ebay getting into hot water with the federal government over a non-poaching agreement that they put together with Intuit. They both agreed to not poach the others tech people by offering them better pay and benefits to switch teams. The idiots at the tech forum came marching in, saying that companies should be able to make any kind of agreements between them and the government should stay out of it. The pro-business, anti-government ball started rolling until a couple of people came in and pointed out to them that this anti-competitive agreement between Ebay and Intuit had obstructed the free market and depressed the wages and benefits that the tech employees of these companies could earn by moving to a better paying job.

The topic died at that point and the glibertarians were last seen slinking away in embarrassment once they realized that they were advocating cutting their own throats.

Litlebritdifrnt

I have an idea, hows about all of those fucking CEOs and wot not who are earning those huge bonuses and are bitching about cutting hours cause their bottom line is being hurt are REQUIRED to work for a month like one of the people earning them those bonuses. Lets say the CEO of those Denny’s in Florida is required to work as a line cook, or a server for a month. I am betting the sniveling little shits couldn’t last a week let alone a month.

Scotty

I disagree with the right in their call that raising tax rates on the wealthy will hurt the economy, but making comparisons that tax rates in our current economy should be the same as economies of old misses the big picture. The economy in the 1950’s is not like the economy of today. Nor should prescriptions to solving economic problems be based on what might have worked with Reagan in the 80’s or Clinton in the 90’s. Look to solutions that world toward the future, not the past.

El Cid

A more equal society in which the rich would still be fantastically rich but in which the overall quality of life, infrastructure, human investment, etc., was much higher would deny them the vast social distance they currently enjoy between their magically boosted elevation and the desperate peons far below.

You know, like the sorts of societies they admire and most of us would hate, like 1970s junta states in South America with gleaming new boondoggles of shining downtown cities where the super-rich lived and worked making their nation’s wealth flow to foreign investors and the professional class which served them directly, and then a large barely surviving working class, and then a large sector of the super-impoverished clinging to hand-build shanties on hillside slums.

We look at that and say, my, how terrible, we’re so lucky not to be in that situation right now.

They look at that and say, wow, that’s kind of ugly, but man, those parasites certainly aren’t taking a lot of taxes out of the job creators!

MikeJ

@Scotty: If the guillotine worked before it can work again.

Davis X. Machina

So much of this discussion is about the top marginal income tax rate, but any rich person worth their salt has as little of their income materialize as income, instead of capital gains.

Which are taxed at 15%, provided the appreciating asset is held for at least a year. Same for qualified dividends.

Most GOP tax plans zero out taxes on non-wage income.

I’m pretty sure this is because wages are derived from work, which Genesis tells us is punishment for sin. The other stuff, well, that’s derived from wealth, which is naught but the outward sign of God’s election.

Come to think of it, it’s presumptuous at best, and blasphemous at worst, by substituting the fallible judgement of mortal legislatures for His ineffable decrees, to second-guess how He distributes those signs of election.

Full Metal Wingnut

@Tom The First: The way it works is that there are different brackets, with marginal increases in each bracket. So each *additional* dollar made past a certain point is taxed at the higher rate (hence the name marginal).

So for the sake of simplicity, lets say your taxable income is 100k and that there are 3 tax brackets: 10, 20 and 30%.

And let’s say that for income up to 25,000 is taxed at 10%, up to 50,000 is 20%, and everything above that is 30%.

That means you pay 10% of 25,000, 20% of your money from 25,000 to 50,000 (25,000) and 30% of the excess of 50,000. So you pay 2500 + 5000 + 15,000 = 22500.

That means your marginal tax rate is 30%. Every additional dollars you earn is taxed at 30%. The percentage of your total income that you pay in this case, though, is 22.5%

Davis X. Machina

@Scotty: OK. Point taken. The top marginal income tax rates should be what they soon will be in France.

That would be forward-looking, not backward looking.

Full Metal Wingnut

Even if you understand what marginal means, 90% is astronomically high. It depends on where you put it though. I think of we brought back a high 70%+ rate, it should be for over 1,000,000 or maybe higher. A 90+ rate basically says that you’re not allowed to make more past a certain point (I mean, keeping 10% of the excess of, say,

500k is still 50k, but its still a steep tax)

jnfr

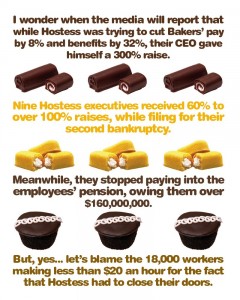

Love that Hostess graphic. Is that yours, John, or do you have a link to wherever it came from? I’d love to use it with a link back.

Glidwrith

@Bill Arnold: Spent over two hours with my father trying to convince him that the government doesn’t tax you then leave the pitiful remnants to be re-invested in your business. Got the brush off when I tried to point out how marginal rates work, then had an epiphany when I figured out he hasn’t done his own taxes in years. End of the story: he called me a communist in front of the entire extended family.

Full Metal Wingnut

@Full Metal Wingnut: I didn’t account for the zero bracket I just realized, but its not necessary to illustrate the concept.

gwangung

Hm. Wonder why a lot of Hispanics aren’t cottoning to Republican policies even when you take immigration out of the equation?

jl

The deluded Cole, apostate and weak minded dupe of liberals, does not seem to know that Eisenhower had been IDd as a known commie decades ago.

BTW, the Wikipedia history of Hostess Brands is a hoot. Decades of corporate acquisitions, mergers, privatizations and going back public. I find it hard to follow, but looks like the borglike corporate entity that (I think) owns the killer snacking cakes machine now was once a computer technology firm.

Looks like these high priced arrogant corporate suit nincompoops and thieves have swept a path destruction through halfway decent food for decades. They effed up some bakery they bought in an attempt to wonderbreadize it, and no one wanted the newfangled stinking bread anymore.

They bought up and shut down an old time SF Bay sourdough bread bakery.

You want links. I got stinking links.

Hostess Brands

http://en.wikipedia.org/wiki/Hostess_Brands

and this epic Wiki entry which every decent minded right thinking person should read.

History of California Bread

http://en.wikipedia.org/wiki/History_of_California_bread

Full Metal Wingnut

@Scotty: well, I agree with the looking forward bit. But this also does not consider that there’s more to tax policy than revenue-raising. There’s also the element of income redistribution and rectifying income inequality. Whether you think the tax system should be used for that purpose is irrelevant-it’s a potential function of taxation separate from what you’re arguing.

Also, for the love of FSM, is Congress finally going to axe the AMT?

blingee

I don’t get this where everyone is so concerned about Republicans lurch to the right. FUCK EM!

It’s been working pretty good for Dems so far. As more and more Dems and less and less of the wingnuts get elected it will all self correct anyways. For now I want to see all those assholes spewing on Faux as much as possible. The more they are out there for everyone to see the better.

They already lost the fiscal cliff debate. Some of them just don’t realise it yet. So as far as I’m concerned I want all these assholes still arguing for extending Bush tax cuts to be out there as much as possible throwing red meat to their millionaire/billionaire donors and cousin marrying wingnut base. It will make the blow back to their inevitable loss on this that much more severe.

Full Metal Wingnut

@Glidwrith: I always thought that most people who aren’t rich or upper middle class (or at least weren’t there whole life) have done their own taxes at least once in their lives. And if you’ve done your own taxes how can you not grasp marginal tax rates?

Davis X. Machina

@Full Metal Wingnut:

TurboTax. There’s doing your own taxes and ‘doing your own taxes’.

Felonius Monk

But what truly defies logic in this whole thing is the huge numbers of people making $20K, $30K, maybe even $50K who continue to vote for Republicans. They certainly aren’t voting in their own interest and they gain nothing from the tax breaks for the very wealthy — I just do not understand their mentality. Obviously, large numbers of these people voted for romney in this last election and not all of them are racist or anti-abortion or whatever.

Regnad Kcin

@Baud: You know who else blamed other people?

A moocher

@different-church-lady: we shall be lucky if John’s “backlash” is in time and string enough. Because the other way you can sustain an oligarchy is by death sqauds, and I think the elite are at most two paces away from that. If security agents can pepper-spray peacful protestors and get away with it, what exactly would prevent murder under cover of night? And then the tortured bodies start turning up in the street in the thousands, and who will do thing about it, once it starts?

Full Metal Wingnut

@Davis X. Machina: I guess I’m old school. The same people who complain most bitterly are too lazy to look beyond the software to see how exactly the gubmint determines their tax burden? Can we teach basic federal income tax in high school?

Maybe if people actually looked into it more carefully they wouldn’t get apoplectic about the historically low Bush tax cuts going up what? 4% or something?

Davis X. Machina

@Felonius Monk: They’ve defined ‘interest’ in non-economic terms. Homo oeconomicus is a mythical beast on the left and the right.

Mnemosyne

@jl:

You can get surprisingly tasty bread at Disneyland because the Boudin “outlet” there is an actual onsite bakery that supplies both theme parks, the Disney hotels, and (IIRC) a couple of the Downtown Disney restaurants as well.

danimal

@Full Metal Wingnut: Back in the day of 70 and 90% marginal rates, there were a whole lot more exemptions and deductions which effectively lowered the tax bill. For example, interest on car payments and the cost of a “business” lunch were deducted.

While I support higher rates on the well-off and think the tax equity pendulum swung too far to the right, we really would cause problems if we tried to reinstate the tax code of the 50’s. But pushing back on today’s ridiculous concentration of wealth is unreservedly a good thing.

Glidwrith

@Full Metal Wingnut: Damned if I know. Dad worked his way up to middle-class earnings until my mom started a business when I was a kid and they scraped together enough cash to purchase a rental property not long after. I suppose the tax picture got complicated so early that they never did do their own taxes. I don’t remember a single instance of either one sitting down to do a 1040. Nowadays, they are both full metal wingnut listening exclusively to Faux New – I’m rather surprised they haven’t disowned me.

Arclite

And yet almost half the people voted for him. Insane.

jl

@Mnemosyne:

I did not know that. But do you mean Disneyland in Anaheim, or the Disneyworld empire in Florida? I didn’t know there were Disneyland restaurants in Anaheim.

The Boudin Bakery at Fisherman’s Wharf in SF is a kind of bakery amusement park in itself BTW.

Boudin is tasty, but sometimes like eating a brick, with a crust about as delightful as rich Corinthian leather. But, I admit, tasty, and usually does come out like regular bread and you do not risk losing a tooth trying to eat it.

Glidwrith

@Davis X. Machina: Turbotax will at least tell you what percentage of your income went to state and federal. I think most people just do the equivalent of Tab A into Slot B, slide their finger along the numbers tables and Bingo! There’s how much tax you owe with absolutely no understanding of how they got there.

Full Metal Wingnut

@Glidwrith: I’m surprised I haven’t been disowned too, coming from a Cuban family. I like to think I’m the voice of reason at thanksgiving, but I think I’m just seen as the mentally ill token liberal of the family.

Maude

@jl:

A lot of companies started being destroyed in the late 1880s with M&A. The attitude toward employees changed from employees being part of the company to employees as almost enemies.

The pride in make quality products went down the drain.

The rich, based solely on money began being seen as morally superior to everyone else.

This was the Reagan Doctrine of social inequality.

I must add that Clinton signed legislation that was beyond Regan’s wildest dreams.

The 2012 election shows that the country has had enough and that we are reversing the damage done to the majority of the people in the US.

The 1% and their snotty attitudes have been told to stick it.

Mnemosyne

@danimal:

Actually, in a consumer-supported society like this one, it might not be totally crazy to bring back the tax deduction for the interest payment on your car loan or other tax breaks that encourage people to buy durable products. There’s a reason some of the most successful programs in the stimulus were things like Cash for Clunkers or giving people tax incentives to purchase newer (ie more efficient) appliances like refrigerators and washing machines.

IMO, one of the biggest problems with our economy is that we got rid of all of the tax shelters that were investing in construction projects and made it less attractive for companies to put their money into upgrading facilities, improving equipment, etc. Those are the kinds of incentives we need to bring back.

(Note: I am not a tax expert of any kind whatsoever, so the odds that I’m talking out of my ass are pretty high. Still, it seems like common sense to encourage people to put money towards actual physical products like infrastructure and durable goods rather than churning it on the stock market.)

jl

@different-church-lady:

” The thing they seem to have lost track of is that you can run a oligarchy on bread and circuses, but not if you stop giving out the bread, and replace the trapeze artists with lecturing. ”

I think both Nixon and Reagan understood that. If I understand my reading about Nixon’s attitude correctly toward stuff like the EPA, it was bread and circuses to him. Throw the masses a little clean air and water and keep them occupied with that for awhile. I read he didn’t give a shit about economics and held economists in contempt and considered them useful idiots. Too bad he was a criminal paranoid nutcase.

Chris

@A moocher:

Yeah, I have to admit that I don’t regard the possibility at all as remote. They already see us the way Central American aristocracies saw the peasants, and they’ve already supported massive expansions of the security state. I wouldn’t be too surprised if your fears in that respect were realized.

PJ

For those on the East Coast, who thought they might have to go through a highly-processed snack cake withdrawal prior to the “shocking” announcement that Hostess is not, in fact, going bankrupt immediately, there is still Tastykake, which provides that processed-sugar high, is unionized, and is apparently in no danger of going out of business.

magurakurin

@Felonius Monk:

Imagine how early 20th century Marxists felt when the workers of Europe filed into the trenches and murdered each other in their millions for their capitalist overlords. Humans just don’t seem to identify primarily with their economic class. It’s enough to make you dada.

MikeJ

@Full Metal Wingnut:

Obama won Cubans this time.

Chris

@Maude:

If you invest nothing but the absolute bare minimum in your employees, they will invest nothing but the absolute bare minimum in their work. A lesson they absolutely refuse to learn.

Felonius Monk

@Davis X. Machina: You’re probably right. Lots of people I talked to both before and after the election seemed to believe in the tooth fairy.

PurpleGirl

@LanceThruster: Glob

I love the new term; I will be borrowing it.

jl

@Full Metal Wingnut:

” I’m surprised I haven’t been disowned too, coming from a Cuban family. I like to think I’m the voice of reason at thanksgiving, but I think I’m just seen as the mentally ill token liberal of the family. ”

Are you the youngin’ of the family? Most of the younger Cubans I met in LA while in college were NOT very conservative at all. I think there must be a big generational divide, at least in CA. Not sure what the CA Cuban community amounts to, except, there are some really good Cuban restaurants down around LA.

MikeJ

@Mnemosyne:

It’s obvious that you aren’t a professional economist. You based your hypothesis on evidence you had observed in the real world rather than on theology.

Mnemosyne

@jl:

There is only one Disneyland, and it is in Anaheim, with one additional theme park (Disney California Adventure) next door to it. The one is Florida is Walt Disney World (aka WDW) and is made up of multiple theme parks (The Magic Kingdom, Epcot, Disney Hollywood Studios, etc.) What both California and Florida have is an area called Downtown Disney that has restaurants, shops, etc. that is separate from the theme parks and does not require admission. So if you’re not huge on rides, you can get a lot of the “Disney” experience for free by going to Downtown Disney.

The cool self-sufficient thing they have at Disney World (in Florida) is their giant hydroponic garden where they grow most of the produce that they use in the parks. And, yes, you can take a tour if you’re nerdy enough. One of my co-workers always tells people they have to check it out if they go there.

Baud

@magurakurin:

It’s definitely lower on the priority list than a lot of other things.

JoyfulA

@Davis X. Machina: The last time I did my own taxes, I looked up my taxable income after deductions on the charts in the IRS booklet, which gave an exact number. No percentages involved. All the math came before that point.

(Then I remarried. I could do my own self-employment taxes, but not his dividend from a Canadian company that somehow he was a limited minipartner in, and all that sort of stuff, so we used Turbotax, which made such a mess of our taxes that I was corresponding with various tax authorities for four years. So the next year we went to a CPA and lived happily ever after. I am now unaware of income taxes except for the dollar number to pay to whom and when.)

Chris

@Maude:

The problem is, the 1% has an energetic and motivated support base right now that’s not going anywhere, even if it’s consigned to minority status.

At least rural populists and urban progressives a hundred years ago had the same target – New York bankers and the like, the 1% of their day – even if there was a huge cultural gulf between them. What we’ve got now is as if the William Jennings Bryan and Huey Long crowd, instead of rebelling against the 1%, flocked to their flag to serve as footsoldiers in the war against the urban unions and machines.

jrg

@Bill Arnold:

“The big trouble with dumb bastards is that they are too dumb to believe there is such a thing as being smart.” – Vonnegut

I think a lot of “conservatives”, if they even consider this, must believe it’s something the people writing tax law must have missed.

It reminds me of when Fiorina was running, and Republicans refused to believe she had a bad reputation in the tech industry that preceded her entering the race. Fucking retards thought we just made it all up, or were getting talking points from Soros’ underground lair.

Full Metal Wingnut

@MikeJ: Not in my family.

But a plurality of “my people” that I know are Obots like me.

Baud

@PurpleGirl:

Heretic. FSM is Lord. Glob is a false god.

MD Rackham

@MikeJ: The best part is that they’ve already rounded themselves up in gated communities.

I don’t generally approve of “canned hunting,” but…

? Martin

@MikeJ: No he didn’t. He lost it by 10 points.

Most interesting in there was 42% of Cubans saying Obama was hostile toward Latinos vs 2% saying Obama doesn’t care about Latinos. That’s completely disassociated from every other Latino group. There’s something in the community driving that – either in Cuban media, or something. It’s completely bewildering.

Mnemosyne

@MikeJ:

I know, silly me — I’m thinking about what would be best for the economy as a whole instead of what’s best for the 0.01%. :-)

jl

@Mnemosyne:

Thanks for the info.

” you can get a lot of the “Disney” experience for free by going to Downtown Disney.”

Oh joy of joys. Too bad I missed that. My experience of Anaheim the city as an adult was driving through it to get to campuses where I was teaching. I guess I missed the Disney Downtown, or did not notice it.

Full Metal Wingnut

@Chris: I’ve come to believe (having recently started a very small, very niche software company) that the best investment you can make, hands down, is people. But maybe I’m one of those commie “job creators” who thinks that creating my own job and being my own boss is enough of a reward.

different-church-lady

@Full Metal Wingnut:

Pretty damn easy: if you’re not making a bundle, then you just do your figures, and look up your tax on a table. There’s no marginal rate calculations to do unless you’re in the stratosphere.

I do my own taxes every year, and I never really understood how progressive things were until the one year I made six figures — and I went, “Wow… uh, that’s a LOT more than I was expecting.” But I was perfectly happy to shell it out, because even after taxes I still had more money than I’d ever had in my life (or since).

different-church-lady

@jl:

What do both those cats have in common? A: they’re long dead.

Clean air and water aren’t exactly little things, no?

Full Metal Wingnut

@different-church-lady: I mean, I’m certainly not rich, I guess I don’t understand when people (really, just the people who complain) lack the curiousity to examine the tax system more closely.

different-church-lady

@? Martin:

Well, he’s yet to hunt down and kill Castro. Understandable, really.

different-church-lady

@Full Metal Wingnut: Epistemic closure and curiosity are kinda mutually exclusive. If one’s entire worldview is based on being able to say self righteously that one pays half one’s income in taxes, then curiosity ain’t gonna help achieve that.

Xecky Gilchrist

@MikeJ: Obama won Cubans this time.

I’ve heard the gambling tourists could do that too, back in the Batista days.

FlipYrWhig

@Felonius Monk:

They believe that Democrats are hellbent on taking their money and giving it to Those People, which isn’t fair, because they work so hard and ask for so little, while Those People sit on their butts all day asking for a handout. By voting for Republicans, there’s a chance at cutting off the lazy moochers.

What’s even better about this framework is that if someone who votes for Republicans gets cut off from some kind of government assistance (which is totally temporary and not like a lifestyle, the way Those People do it) _by a Republican government_, well, it’s _still_ the fault of Democrats, for squandering all the money on Those People in the first place.

But, in all seriousness, this is the single biggest driver of voting for Republicans: people vote for Republicans to help stop Democrats from doling out goodies to the undeserving. In other words, “welfare.”

Full Metal Wingnut

@? Martin: it’s because we are by and large disassociated from every other Latino group, at least the ones who came in the wake of Castro (overwhelmingly white and previously middle to upper middle class). Not to mention immigration policies far, far more favorable than for any other Latino group (historically). My people can’t relate.

JCT

@jl: Actually what you really missed was the surrounding area where most porn films originated. An entirely different Magic Kingdom.

Calouste

@Chris:

As the saying was in the Soviet Union: “They pretend to pay us, and we pretend to work.”

FlipYrWhig

@Full Metal Wingnut:

People seem to take a perverse pleasure in feeling like they’re getting royally hosed by life. It’s not just on the right, but it’s REALLY common there.

PurpleGirl

@Davis X. Machina: Also there are fewer actual brackets now. In the 1950s there were many more brackets. I’m not sure when they flattened the brackets, though.

PurpleGirl

@danimal: Once you could also deduct the interest paid on credit card balances.

Full Metal Wingnut

Kinda like tax deductions, this turn of history. Once you give people a deduction, they’ll think they’re entitled to never be taxed on it, and good luck changing that.

And once you let the “job creators” like Papa John think they’re “entitled” to mansions and servants and extravagant lifestyles by virtue of their exalted status, they’ll throw hissy fits if they have to sacrifice a yacht or second home to provide their minimum wage employees with a basic human right.

SiubhanDuinne

@Full Metal Wingnut:

What!? But wait, what if I need cash on the weekend or a holiday, for instance on Thanksgiving if I only have a $10 bill but I need to buy $15 worth of pumpkin pie to take to grandma’s, I would have to stop at the AMT to get some money and …. oh? …. what now? …. ATM?

….

Never mind.

/Emily Litella

Davis X. Machina

@PurpleGirl: IIRC 1983.

Maude

@Chris:

Times they are changing.

Pay attention to what is going on in manufacturing. Go to Business week.com over at Bloomberg.com and read the article on Designers and made in the USA.

It shows that very small businesses are finding their way.

There is now an online list of businesses that are small. Also it helps find suppliers.

This is the beginning of the turn around.

People will buy USA for the quality and the extra cost isn’t that high.

I watched to jobs go offshore and I will watch the jobs come back.

The support for the 1% is small. Their power has been depleted.

Watch for signs that the wealthy are not displaying their wealth. During Reagan, the rich started flaunting their wealth.

It’s what we as a society will state is acceptable.

If you don’t watch tv news, it’s easier to see the turn around.

Steeplejack

@Full Metal Wingnut:

Historically, the top marginal rate has always been applied at a very high income level. The 91% rate that obtained during the ’50s kicked in at $200,000, which would be about $2.3 million today, and that was a holdover from World War II austerity measures. In the late ’30s the top marginal rate was 70% on income over $5 million (about $80 million today). And in 1964 the rate was put back to 77% on income over $400,000 (about $2.9 million today).

During the Reagan years the top marginal rate went from 70% down to 28%, although that latter rate applied to income over $29,750 (about $56,000 today).

danimal

@PurpleGirl: @Mnemosyne: Thanks. I don’t have strong opinions on the various deductions; economists say they are a distortion, but obviously if I had to choose between buying a car or paying higher taxes, I wouldn’t think for long.

I just see all the “90% tax rate” stuff and it doesn’t capture the entire reality. 90% with today’s tax code would be crazy.

Peregrinus

@@Martin:

Depending on the Cubans, there’s a racist element to that – most of my older family is certainly not above using certain words to refer to the President, or their Spanish equivalents (the phrase is el negro de mierda ese). To her credit, my grandmother has never taken that shit from her family, though that’s probably at least because her favorite grandson (yours truly) declared himself a Democrat . . .

Rush Limbaugh was sort of right about Cubans, except that I’d reverse it. The Cubans I hang out with think they’re better than all other Latinos and that Obama and the Dems are trying to make the other Latinos depend on them, unlike the Cubans, who are smarter and more hardworking. I think other Cuban communities are way different from this, though.

I once got my cover blown at Thanksgiving by my great-aunt saying “careful what you say, we have an Obama voter in the room,” and one of my cousins thankfully said “Yeah, I voted for him too.” I was amazed.

Ruckus

@Full Metal Wingnut:

If you do your own taxes and they are not that complicated because you don’t make a lot then you just enter the numbers from the book and you are done. The marginal rate math is done for you. It’s only when you make, well let’s face it-more than me, a reasonable sum and do your own taxes manually that you would notice.

? Martin

@Full Metal Wingnut:

No, I get that. I understand why Cubans and other Latinos don’t always share the same interests.

What I don’t get is why 42% of Cubans view Obama as ‘Hostile toward Latinos’ while only 10% view Romney that way. That’s a very specific thing and must come from a very specific attitude within the community.

Cubans like Obama’s immigration policy and a number of his other policies, so the answer isn’t in that poll. Other Latino groups don’t share that attitude – at least not nearly to that degree. So, where does this attitude come from? Further, it’s a very specific Miami-Dade thing. Who’s on the radio down there.

Steeplejack

@Full Metal Wingnut:

Even if you do your own taxes (manually), it’s easy to miss the marginal tax rates, because most people just look up the tax owed in a chart: if your adjusted gross income is x, you pay y. I doubt many people even do the exercise of dividing y by x to see what percentage tax they ended up paying. They just know it’s too much!

Rosie Outlook

@MD Rackham: I’ll work on my knitting lessons while watching the canned hunts on TV (probably the Fox network).

In more primitive times, Mme. Defarge had to get dressed and haul that knitting all the way downtown to be entertained while working.

Ruckus

@Maude:

I seem to recall a tale written by a fellow named Dickens that seems appropriate concerning bosses and workers. I believe it concerned a time prior to the late 1800’s.

pseudonymous in nc

@gwangung:

That is a very smart observation. If you come from — or have a cultural memory of — the rich/poor divide in countries with both slums and lavish gated homes, then you don’t necessarily see the American Dream in terms of a gated community.

jl

@pseudonymous in nc:

” If you come from—or have a cultural memory of—the rich/poor divide in countries with both slums and lavish gated homes, then you don’t necessarily see the American Dream in terms of a gated community. ”

Especially if, like many immigrants from Mexico and Central America, you grew up on the ‘wrong’ side of the gate.

Gwangung

@pseudonymous in nc: yeah, talk of welfare cheats don’t resonate when a) you’re part of the welfare takers and, more important, b) are well on your way to getting off of it y your own hard work. You ant ask your parents for a $20k loan when they are as poor off as you…but you ca see white business wers getting he same kind of help.

Matt McIrvin

@different-church-lady:

But if you look at the rest of that table, you can see that the tax goes up gradually as taxable income increases; it doesn’t suddenly jump when you cross a bracket boundary. Granted, nobody has to examine the whole table to do their taxes, but if they’ve got those tax booklets in their records, they could at least go look at them when challenged on it.

danielx

@cathyx:

They don’t want to go back to that part of the fifties, they want the part where everybody believed the government, white men ran everything and women, children and minorities did as they were told.

Those are the ones who don’t want to go back to the 1850s, and there’s a significant number of them, too.

Gwangung

@jl: frankly I think they see republican policy as trying to. Pose e rigid c.ass structure, complete with corrupt cronies, that Ry were fleet to America to get away from. And this applies equally well to Asian groups…

? Martin

The only people that intuitively understand marginal taxes are people that actively are trying to avoid paying taxes.

That’s it.

danielx

Yup. Marxism as a basis for either a political or economic system pretty well sucks…but as an analytical tool it has much to be said for it.

El Cid

I explain marginal tax rates to people I know by emphasizing that it’s your dollars which are taxed, not you, and they tax your dollars differently based on how many there are.

Up until a certain amount, your dollars are taxed at a certain rate.

Your dollars above that but below another level, at a higher rate.

And so on.

Ted & Hellen

So why IS Obama pushing a plan featuring a three to one spending cuts to tax hikes ratio?

Anyone going to reply to the issue raised above?

Matt McIrvin

@FlipYrWhig: Maybe it’s just that I grew up in the DC suburbs, but it seems to me that a substantial number of middle-class Republicans actually work for government contractors, particularly military and aerospace. When they talk about cutting government spending, they’re excluding the spending that goes into their own pockets, which is of course essential. The bad spending is the kind that’s competing with them for government funds.

You see an extreme version of this in the right wing of the science-fiction/space-fan community, which got many of its attitudes about cosmic manifest destiny from the California aerospace engineering community of the mid-20th century. There’s something of a split, in that some of these guys who self-identify as libertarians also advocate massive government spending on space exploration and development, and others think it should be left to titans of private industry. But the two camps will agree that the moocher state is keeping us from colonizing the stars.

mai naem

There was some dumbass dentist from the South, I cannot remember if it was 2008 or 2010, who was talking about making sure she was going to make less than 250K because the tax rates going up were not going to be her worth making more than $300K. Keep in mind, this is a woman with a post-grad education. My sis told me the dentist she had my niece’s braces done at was talking about how only people who owned property should be able to vote. This was last year 2011. He was also bitching about how much property taxes he was paying for all this rental property he had bought. My sister was biting her tongue, because she really really wanted to tell the twit that nobody held a gun to his head forcing him to buy this rental property.

Matt McIrvin

@Full Metal Wingnut: In principle, the AMT is actually a fine idea; it was supposed to keep billionaires from avoiding income tax entirely by piling up various deductions. In practice, I mostly see it zapping middle-class people who got compensated with stock options, exercised them and were foolish enough to hold onto the shares.

It seems to me that it could be made sensible again, mostly by having it kick in at a higher level.

Chris

@Peregrinus:

Ironic. Cubans are the only ones who get no-questions-asked automatic amnesty the second they set foot on American soil, have absolutely no need to demonstrate any skills or value to the country they’re immigrating to, yet THEY’RE supposed to be the ones the “smarter and more hardworking ones.” Yeah…

Chris

@jl:

It probably also doesn’t hurt that a lot of these countries were ruled until the nineties or so by fascist regimes openly propped up by the United States.

The Cuban regime is left-wing and anti-American, so immigrants who come from there are primed to be less favorable towards left-wing rhetoric and more favorable to American-Dream type stuff in general, I would think. Whereas their Central American counterparts would have a much more jaded view of both the U.S. and right-wing politics.

Chris

@danielx:

That pretty much sums up my opinions, as well. Bad with prescriptions, but not so bad with the diagnosis.

JWR

Some of you on the right coast may already have seen this, but I just saw Scott Pelley, (Bob Scheiffer’s understudy), interview “Lord” Blackfein, (or whatever his name is), the head of Goldman-Sachs. Pelley asked him about the “fiscal cliff”, and after several minutes spent discussing how people are going to have to learn how to live within their means, to not expect to ever receive what we were promised from Social Security and assorted other programs, maybe then, he says, we can have a little chat about tax rates. That this guy is rolling in Our dough seems not to bother him one bit. Infuriating.

Chris

@Matt McIrvin:

Also from the DC suburbs, and put ‘er there.

The white, suburban upper-middle-class conservative civilians whose livelihood depends on the Pentagon (either bureaucrats or private contractors) are easily the most insufferable pricks I’ve ever met from that side of the aisle. Rich New York 1%ers’ kids, red-state fundiegelical crusaders, the Cubano conservatives down here in Miami, no one else even comes close. And that’s saying something.

(Feel really bad for all their Arab and Persian neighbors in northern Virginia).

Raven

Heron in flight at sunrise.

Phoenician in a time of Romans

Incidentally, there’s been analysis of the historical data –

http://www.angrybearblog.com/2010/12/top-marginal-income-tax-rate-should-be.html

Based on history, the top marginal rate yielding the best economic development should be around 65%. Not 90% – but far, far more than 35% or 38%.

Gwangung

@mai naem:

In the fundraising world, dentists and doctors are known for their conservative property management skills. In other words, they’re often dumb as stumps when it comes to the money—they leave a lot of it on the table….

? Martin

@Phoenician in a time of Romans: Well, that’s a crappy analysis. It assumes that top marginal tax rates and economic growth are in any way related. They aren’t. They can’t be – particularly when it excludes the threshold for that top rate to be established. There were periods in our history when the top rate was paid only by dozens of people. Taxes on dozens of people can’t possibly be in any way related to national economic growth.

There’s no simply way to relate the two, and it’s pointless to try. What would be a more appropriate analysis would be to look at overall revenues related to economic growth (does the government take too much out of the economy that it suppresses demand), look at economic mobility (does tax policy lock people into their economic classes? In order for people in lower classes to be able to rise up, it necessitates that people up higher need to fall if they don’t perform – undertaxing the rich guarantees they’ll stay in their class, regardless of performance), and look at whether government spending (the product of taxation) yields the mobility outlined above – through jobs, economic growth from infrastructure, etc.

We know that the only thing clearly happening here is that we undertax the rich. It’s virtually impossible for the rich to fail in this country – to stop being rich. That steals opportunities from people in lower classes to outperform and join that class.

Villago Delenda Est

AKA the fucktards.

TS

My first ever job after graduation (1967), the CEO of very large company where I worked earned about 10 times my salary. A CEO of such a company now, earns 200-300 times the salary of a new graduate.

I can see where an entrepreneur who invests may earn a large return on his investment – but how can any person – as an employee – be worth millions of dollars in salary???

Chris

@FlipYrWhig:

Last point –

This is also why you’ll never get anywhere with them with the argument, beloved of progressives, that the welfare state is an insurance against revolution.

Yes, sure, they could pay higher taxes to support a welfare state and stave off revolution. But to them, that’s somewhere between “giving in to extortion” and “negotiating with terrorists.” It may be expedient, but it’s not right that they should have to pay protection money to savage union thugs. Better to sink the money into a massive security state that’ll shoot the uppity thugs whenever they forget their place. It may not be cheaper, but as a matter of principle it’s the right thing to do.

? Martin

@TS:

Easy – they’re 300 times better than you are as a human being. Do you have any idea how much money Mitt Romney gives to charity?

different-church-lady

For reasons I won’t bother explaining, I was reading up on William Jennings Bryan’s 1896 “Cross of Gold” speech, when I come across this:

Plus ça change…

Cmm

Given the topic of people voting against their own interests, is it still worthwhile to read What’s the Matter with Kansas? I picked up the e-edition cheaply at some point and read the intro today while casting about for a new book to start on. Is it outdated or disproven or not thought well of, or is it worth it? The intro went down smoothly enough and it seems interesting.

A moocher

@Matt McIrvin: re the science and space fan community, you might find this piece of net.sociology to be of interest. From 1988.

http://www.megalextoria.com/usenet-archive/news085f1/b106/sci/space/shuttle/00001237.html

BobS

@Vince: Another aspect of tax policy that many people seem to be unfamiliar with is the cap on Social Security taxes- this year, it’s around $110K, meaning once you earn that much you pay no more Social Security tax. With the rate at 6.2%, it means you can subtract around $3.5K from the earnings of Person A’s $47.5K, and around $6K each from Person B’s $87.5K and Person C’s $687.5K.

rikyrah

the hostess graphic rocks

Phoenician in a time of Romans

@? Martin:

@Phoenician in a time of Romans: Well, that’s a crappy analysis. It assumes that top marginal tax rates and economic growth are in any way related. They aren’t.

Uh-huh.

—-

And to the inevitable comment that marginal tax rates aren’t the only thing affecting growth: that is correct. The adjusted R Square, highlighted in orange, provides us with an estimate of the amount of variation in the dependent variable (i.e., the growth rate in Real GDP) that can be explained by the model, here 17.6%. That is – the tax rate and tax rate squared, together (and leaving out everything else) explain about 17.6% of growth. Additional variables can explain a lot more, but we’ll discuss that later.

[…]

But what if we improve the model to account for some factors other than tax rates. Does that change the results?

[…]

From this output, we can see that this version of the Kimel curve (I do like the sound of that!!) explains 36% of the variation in growth rate we observe, making it twice as explanatory as the previous one. The optimal top marginal tax rate, according to this version, is about 64%.

As to other features of the model – it indicates that the economy will generally grow faster following increases in government spending, and will grow more slowly in the year following a tax increase. Note what this last bit implies – optimal tax rates are probably somewhat north of 60%, but in any given year you can boost them in the short term with a tax cut. However, keep the tax rates at the new “lower, tax cut level” and if that level is too far from the optimum it will really cost the economy a lot. Consider an analogy – steroids apparently help a lot of athletes perform better in the short run, but the cost in terms of the athlete’s health is tremendous.

—-

You say they’re not related – but you don’t give any proof. Kimmel gives a regression analysis, and concludes that “the tax rate and tax rate squared, together (and leaving out everything else) explain about 17.6% of growth.” – and he gives his numbers.

There’s an old saying about grandmothers and sucking eggs. Are you aware of it?

Yutsano

@TS: The CEO has one major task in the modern era: to maximise shareholder value. That’s it. All else is sideshow and cheerleading. They therefore get their compensation from that value maximisation rather than direct salary. And of course golden parachutes.

Smiling Mortician

@Cmm: Yes. There will always be something the matter with Kansas.

Full Metal Wingnut

@Phoenician in a time of Romans: Kids, what do we know about correlation and causation?

Xenos

@Davis X. Machina:

Turbotax gives a nice little summary that can use to review the real tax rate applied. The first time I got all irritated by finding out that we had lost the tax deduction from 1.5 children due to the alternative minimum tax the Turbotax summary showed that the total tax burden was still under 20%.

That put things into a bit of perspective. You really can’t complain about such a low tax rate without making it obvious that you are a complete douchebag.

Cacti

@Cmm:

Let’s change the title to “What’s the Matter with White People”.

88 percent of Mitt’s support was from white voters.

Steeplejack

@Phoenician in a time of Romans:

Applied starting at what income level?

Another Halocene Human

@Phoenician in a time of Romans: Your copypasta is hard to follow, but I thought Keynesian analysis equates tax cuts and government spending, but government spending has the greater multiplier effect (of course, this presumes the spending is efficient… and we do have experiential data as to what is most efficient, the rest is politics). So if there were a one-to-one relationship we ought to see improved economy.

What’s been discussed is a simultaneous spending cut and tax increase, which is dumb during a recovery.

I think a top marginal rate increase (unfortunately, this is not the only piece of the fiscal cliff) would probably have an understated short term effect on GDP because this money is BEING PARKED ON THE SIDELINES AND NOT SPENT OR INVESTED HELLO.

Another Halocene Human

@A moocher: That post was very apropos.

MikeJ

@Full Metal Wingnut:

It’s usually the best place to start looking.

PurpleGirl

@MikeJ: Correlation and causation are not the same and correlation does not equate with causation.

MikeJ

@PurpleGirl: Things that are most highly correlated are most likely to be causal. It’s not proof, but it’s things that are correlated almost always have something to do with the cause.

Nobody would have ever figured anything out from the beginning of time if there was no correlation between cause and effect.

Full Metal Wingnut

@Chris: BUT GOVERNMENT DOESN’T CREATE JOBS!!1

Phoenician in a time of Romans

@Another Halocene Human:

@Phoenician in a time of Romans: Your copypasta is hard to follow, but I thought Keynesian analysis equates tax cuts and government spending, but government spending has the greater multiplier effect (of course, this presumes the spending is efficient… and we do have experiential data as to what is most efficient, the rest is politics). So if there were a one-to-one relationship we ought to see improved economy.

This isn’t Keynesian analysis – this is a regression analysis based on historical data. The standard conservative mantra is “lower taxes, faster growth”; the data, as shown by this analysis, shows otherwise. There are obviously many factors affecting economic growth – low marginal tax rats are not one of them.

As I understand it, Keynesian counter-cyclical spending is designed to reduce the volatility of business cycles, and a stimulus is highly desirable NOW to get the unused capacity back into play, providing demand to get factories and people working again. Your comment about multipliers is, AFAIK, correct, but irrelevant to the point I’m making.

Phoenician in a time of Romans

@Full Metal Wingnut:

Well we know that when one party’s ideology is that there is a positive correlation between lower taxes and growth, and the actual data shows a negative correlation in the range we’re discussing, their theories on causation probably have problems…

Phoenician in a time of Romans

@Steeplejack:

Applied starting at what income level?

I don’t know. I don’t think it’s part of Kimmel’s analysis, especially as I don’t think there’s that much difference between a situation where the top rate affects 1% as opposed to 2% of the population, for example.

My personal preference, if I had to make a plan, would be to set thresholds based on projections of inequality, initially to reduce inequality (say as measured by the GINI) and then roughly maintain it at a more optimal level. I wouldn’t want a communistic leveling, but the current US levels of inequality are socially and economically dangerous.

Matt McIrvin

@A moocher: Hah, yeah, unfortunately we keep needing to write this same essay over and over.

There’s also a substantial number of people who are basically science fans, and want what’s best for science (in 1988 you could identify them by the Carl Sagan quotes, and that’s still the case, I suppose). About half of them are consequently skeptical about sending humans into space at all, since you can do so much with uncrewed probes. The other half basically want to send astronauts to Mars, and will support things that seem to lead in that direction.

Matt McIrvin

@Chris: The “insurance against revolution” argument isn’t a good one, anyway. My understanding is that revolutions tend to happen in times of rising expectations. You can keep them down pretty effectively for a long time by keeping expectations low. The key is just to never, ever slip at repression.

Maude

@Matt McIrvin:

FDR understood that the farmers would revolt. He also knew that a lot of people would join right in.

The New Deal was a practical issue, not a warm and fuzzy set of programs.

Berial

Where does the info in that Hostess graphic come from?

Tmill

Have you even seen that HGTV show ‘Million dollar rooms’? Million…. Dollar…. ROOMS. It should be an investigative expose, and instead, viewers are supposed to ENJOY seeing some jerk and his family enjoying a shower that cost more than their entire home. Shit like this, is served up as entertainment. Should be a REVOLT-ing experience for anyone clicking through on the way to the next fooseball game, and a good place to start making a list.